We began operations when a FEMSA subsidiary acquired Coca-Cola bottlers for the Mexico Valley and the southeastern region of the country.

FEMSA transferred its ownership in the bottlers to FEMSA Refrescos, S.A. de C.V., our corporate predecessor.

We launched our initial public offering on the Mexican Stock Exchange and the NYSE. Alfredo Martínez Urdal was named CEO, and in our first year of operations, we were able to produce and sell around 500,000 unit cases.

Through the majority capital acquisition of Coca-Cola Buenos Aires in Argentina, we decided to cross borders and bet on our first international market.

We acquired the remaining shares of Coca-Cola Buenos Aires, and introduced an innovative pre-sale system and handheld devices in more than 90% of our routes in Mexico and Argentina.

We began operations at our plant in Toluca, Mexico, with one production line and an initial volume of 15 million unit cases.

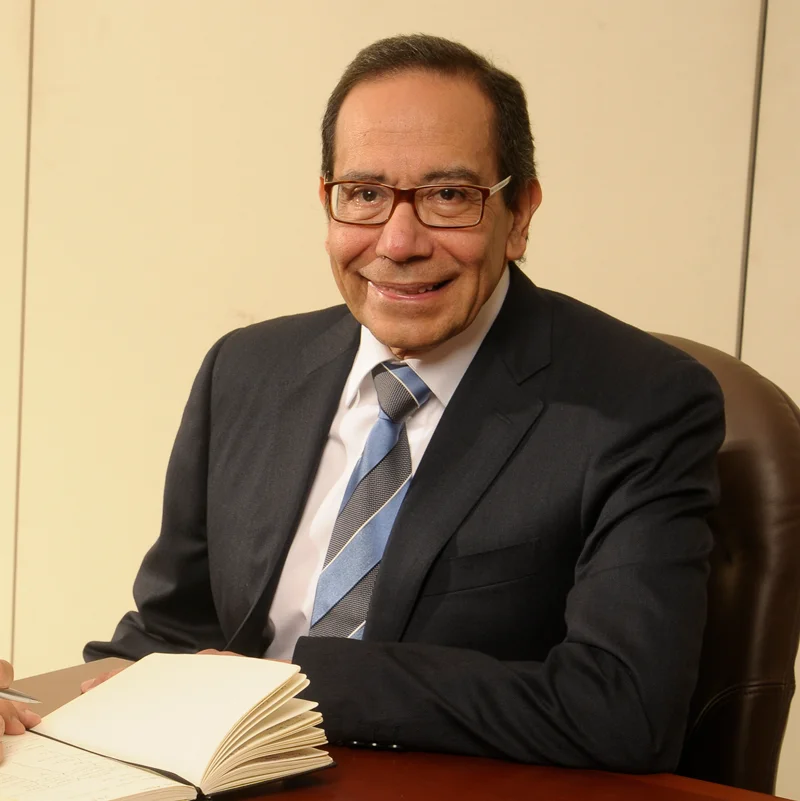

Carlos Salazar Lomelín was appointed CEO of Coca-Cola FEMSA.

We remained at the forefront of the beverage industry with our launch of an innovative 2.5-liter returnable PET bottle of Coca-Cola in Mexico.

We seized a leadership position in Latin America with our multinational acquisition of PANAMCO, expanding our geographic reach to 9 countries across the region. We surpassed 600 million unit cases, a unprecedented achievement for our company.

We founded the first Latin American bottle-to-bottle PET recycling plant in partnership with ALPLA and The Coca-Cola Company.

We broadened our portfolio with our launch of Hi-C brand in Central America.

Together with The Coca-Cola Company, we diversified our portfolio with our joint acquisition of Jugos Del Valle, beginning a new opportunity to satisfy our consumers’ changing needs. We launched Coca-Cola Zero in Argentina, Mexico, and Brazil.

We expanded our position in Brazil with our acquisition of Refrigerantes Minas Gerais (REMIL).

Together with The Coca-Cola Company, we expanded our portfolio with our joint acquisition of the Brisa bottled water business in Colombia.

We partnered with The Coca-Cola Company to acquire Leão Alimentos, diversifying and expanding our still beverage portfolio in Brazil.

We are part of the Sustainability and Social Responsibility index of the Mexican Stock Exchange.

We diversified our portfolio after the acquisition of Estrella Azul, entering the dairy and ice cream industry in Panama. We started operations in 2011 and concluding in 2020.

Committed to our expansion, we have integrated three large business groups in Mexico: Grupo Tampico, CIMSA and Fomento Queretano, consolidating our presence.

Through Jugos del Valle we integrated Santa Clara, expanding our portfolio to the dairy category in Mexico.

We launched FUZE Tea in Latin America.

We entered the Dow Jones Emerging Markets Sustainability Index and the BMV Sustainable CPI.

We consolidated our position as the largest bottler in Mexico with the integration of Grupo Yoli in Mexico.

In Brazil we acquired the Fluminense and Spaipa franchises.

We acquired 51% of Coca-Cola Bottlers Philippines, Inc. beginning operations in 2013 and ending in 2018.

John Santa Maria Otazua was appointed CEO of Coca-Cola FEMSA. We initiated operations at two of the most important manufacturing facilities in Latin America: the state-the-art bottling plants in Itabirito, Brazil and Tocancipa, Colombia.

Through our Leão Alimentos joint venture, we strengthened our position in the value-added dairy category with our acquisition of Verde Campo in Brazil. We began operations in the Tocancipa plant in Colombia.

We started operations at the Tocancipá plant in Colombia.

We managed to strengthen our leadership position in Brazil with the acquisition of Vonpar, reaching 49% of the sales volume in the territory.

We began selling and distributing Monster in most of our territories, entering the energy drink category.

Together with The Coca-Cola Company and the Latin American bottling system, we acquired the AdeS brand, a leader in the vegetable protein-based beverage category, strengthening our non-carbonated beverage portfolio.

We expanded our footprint to 10 countries in Latin America with the acquisition of MONRESA in Uruguay.

We became the first Mexican company to receive the Science Based Targets initiative (SBTi) certification for our greenhouse gas reduction goals.

Coca-Cola FEMSA places a Green Bond for US $ 705 million, the largest in history for a company in Latin America.

We issued the first sustainability-linked bonds in the Mexican market, totaling US $470 million

We acquired CVI Refrigerantes in Brazil

This plant will have the capacity to process approximately 50,000 tons per year of post-consumer PET bottles

Ian Craig becomes the new Chief Executive Officer of Coca-Cola FEMSA