Consistent

Winning

Portfolio Buildup

Aligned with our Strategic Framework, we are consolidating a leading total beverage portfolio with options for every consumer taste and lifestyle, while promoting healthy habits locally—encouraging people across our communities to combine proper nutrition with physical education and activity throughout all stages of their lives.

237

launches in

12 categories

in 2018

Total beverage leadership

Total beverage leadershipConsistent with our consumers and clients’ evolving preferences and practices, we are consolidating a winning total beverage portfolio, offering a growing array of low- or no- sugar sparkling beverages, refreshing juices, nectars, and fruit-based beverages, hydrating purified, sparkling, and flavored water, revitalizing coffee, teas, sports, and energy drinks, and wholesome dairy and plant-based protein products.  Leading the way, we fortify and amplify our total beverage portfolio of consumer-centric brands in line with their changing tastes and buying habits.

Leading the way, we fortify and amplify our total beverage portfolio of consumer-centric brands in line with their changing tastes and buying habits.

Our consumers and customers are at the center of everything we do. By deeply understanding our consumers and shoppers, we act faster than our competitors to adapt our portfolio to satisfy their evolving needs through exemplary product innovation and flawless point-of-sale execution.

+45%

of the launches in our

portfolio are low- or

no- sugar beverages

To satisfy our Brazilian consumers’ varying tastes, we launched Coca‑Cola Plus Café Espresso in our sleek 220-ml mini can. Featuring great espresso taste, less sugar, and more caffeine for consumers on the go, this enhanced Coke is already a big hit. We also launched our first “all natural” sparkling beverage brand YAS. This niche brand, with juice, and with no preservatives or other additives, is already attracting interest from trendsetters at upscale supermarkets and on-premise locations. We further launched refreshing Del Valle Coconut water, along with mango and maracuya-flavored coconut water in single-serve presentations. Through these innovative launches, we deliver premium beverage options to quench the thirsts of our high-end consumers.

Catering to our Mexican consumers’ local preferences, we launched multiple new flavors of our iconic Mundet sparkling beverage brand, featuring tantalizing sangria, tangerine, and apple-peach in our 2-liter multi-serve PET presentation. As we broadened our portfolio to meet local demand, we doubled this brand’s volume year over year, while reinvigorating the Mundet brand among our consumers.

To better serve our consumers and clients, we continue to enhance our point-of-sale execution. For example, in Mexico we increased our ICE score in the modern trade channel by 5.2 percentage points for the year—leading the way for the entire Coca‑Cola system across the country. Among other indicators, our ICE score measures the efficiency and effectiveness of our point-of-sale portfolio, commercial and promotional activity, price communication, and cooler placement. Most important for the modern trade channel is our superior coverage of consumer interaction points within any particular supermarket, including the right promotions, the right products, and the right prices to activate consumer demand.

“The most important thing for the modern trade channel is our superior coverage of consumer interaction points within any particular supermarket.”

Throughout the year, we revitalized our sparkling beverage growth through our focus on affordability. To this end, we continued to satisfy our cost-conscious consumers through our strong platform of affordable, returnable packaging alternatives at the right price points.

“We are consolidating a winning total beverage portfolio, offering a growing array of low- and no-sugar sparkling beverages, refreshing juices, nectars, and fruit-based beverages, hydrating purified, sparkling, and flavored water, revitalizing coffee, teas, sports, and energy drinks, and wholesome dairy and plant-based protein products.”

Through our affordability strategy, our Brazilian operation’s transactions outperformed our volume growth for the second consecutive year in both convenient single-serve packages and multi-serve returnable presentations. To intensify our connection with cost-conscious consumers, we significantly expanded coverage of the two pillars of our Magic Price Points strategy, our affordable single-serve 200-ml PET presentation and 220-ml mini-can, capturing 72% and 37% growth in transactions, respectively, for the year. On top of these convenient, smaller packages, we considerably increased the coverage, as well as the innovative packaging, of our 2-liter multi-serve PET presentation. In addition to extending the coverage of this presentation, we launched duo- and four-packs of our core Coca‑Cola and Fanta brand sparkling beverages of this popular family-size returnable presentation. As a result of our efforts, we grew the volume of this affordable package by over 13%, while significantly expanding its share of sales.

In the face of an adverse macroeconomic environment, we focused on expanding the coverage of our affordable single-serve 220-ml mini-can—along with our 2-liter multi-serve returnable PET presentation—capturing transactions at Magic Price Points for our cost-conscious consumers. Consequently, we improved our competitive portfolio’s coverage by 8% for the year, while significantly gaining share of sales at the low socioeconomic level.

We extended coverage of our 3-liter multi-serve returnable PET presentation of Coca‑Cola for our consumers to enjoy. Specifically, we launched this attractive value proposition in our central and southern territories, while strengthening our position in the Valley of Mexico. Consequently, we not only increased the volume of this popular family-size package by 17% year over year, but also gained market share in this important category.

Our affordable, returnable packages enabled us to increase our consumer base and achieve important volume growth across our Colombian, Guatemalan, and Costa Rican markets. In Colombia, we expanded the coverage of our 2-liter multi-serve returnable PET presentation, enabling us to achieve more than 72% volume growth for this popular package year over year. In Guatemala, we recently launched our 2-liter multi-serve returnable PET presentation in the recently acquired ABASA and Los Volcanes territories, contributing to our almost 11% volume growth in returnable packages for the year in Guatemala. Similarly, in Costa Rica, we achieved more than 16% volume growth in our affordable, returnable presentations year over year.

As the fastest growing category in our industry, we focus on improving our competitive position and capturing the most value from our still beverage segments.

We achieved volume

growth by

25%

in Energy category

in Brazil

To quench active consumers’ thirst for energy drinks, we reinforced our distribution of Monster energy drink across our franchise territories in Brazil. Monster is proving to be one of the fastest growing, most attractive energy drinks for consumers in the country. Together with our Burn brand energy drink, we began to surpass the sales volume of the country’s market leader—an important milestone—and achieved 25% volume growth while significantly increasing our share of sales for the year in the energy category. Additionally, we recently began distribution of our Monster energy drink in Argentina, becoming the top brand in this category across our franchise territory.

We continue to fulfill Brazilian consumers’ growing demand for refreshing juice-based beverages through our popular Del Valle Fresh brand. Utilizing our cold-fill platform, we successfully launched Del Valle Fresh Orange and Lemon juice-based drinks, achieving sales of more than 1 million unit cases a month while rapidly gaining market share in this growing category. Additionally, in the premium juice segment, we launched Del Valle Origens, a 100% apple and grape juice in 1.5-liter glass bottles. Thanks to our bi-modal juice strategy, we grew more than 20% driven by the affordable and premium juice segments, year over year.

In 2018, we continued to build on our prior year’s successful re-launch of FUZE Tea, a fusion of green and black tea with refreshing fruit flavors, across all of our Mexico sales channels. Enabled by our point-of-sale execution and product innovation—marked by our recently launched lychee fruit flavored tea—we expanded our share of sales in the tea category year over year.

To compete in Colombia’s mid-juice segment, we recently launched Del Valle Fruit guava, mango, and tangerine/pineapple in our 200-ml single-serve one-way, 350-ml single-serve returnable PET, and 500-ml PET presentations. With this launch, we entered the country’s largest juice segment. Moreover, we reinforced our position in Central America’s growing juice-based beverage category with our re-launch of Del Valle Fresh in Guatemala and our launch of Del Valle Fresh apple in Nicaragua.

“We increased volume growth by 7.3% year over year in stills category in Mexico.”

In 2018, we continued to accelerate our growth across the dairy category. Under our joint venture with The Coca‑Cola Company, we capitalized on the new state-of-the-art dairy plant in Lagos de Moreno, Mexico—close to milk supply—to meet growing consumer demand for our portfolio of wholesome Santa Clara brand UHT white milk, flavored milk, yogurt, and ice cream products. Among our innovative products, we launched our new line of Beyond Kids ice cream flavored strawberry, chocolate, and chocolate-mint UHT milk with great success. Thanks to our expanded client coverage, marketplace execution, and product innovation, we accelerated our volume growth by 27% year over year across the modern and traditional trade channels, while positioning Santa Clara as the second largest brand in both the UHT white and flavored milk categories throughout the traditional trade channel.

Through our joint venture with The Coca‑Cola Company in Brazil, we switched to an all-natural platform for our premium Verde Campo dairy brand. Already, this innovative new platform—which features no preservatives and no added sugar—boasted 30% volume growth among the country’s most demanding consumers in a high potential market category.

We multiplied

our volume of

AdeS by

2x

year over year

Consolidating position in the plant-based beverage category

After we closed the acquisition of Unilever’s AdeS plant-based beverage business with our partner The Coca‑Cola Company last year, we consolidated this new brand in our key Argentina, Brazil, and Mexico markets, while re-launching AdeS in Colombia this year. Among our initiatives, we refreshed AdeS brand image, enhanced its client coverage and execution, and expanded its portfolio with our launch of almond and coconut dairy-alternative beverages for our consumers’ enjoyment. Thanks to our efforts, we extended AdeS’ footprint across our customer network and increased our share of the plant-based beverage category, particularly the fast-growing seed-based beverage segment.

After we closed the acquisition of Unilever’s AdeS plant-based beverage business with our partner The Coca‑Cola Company last year, we consolidated this new brand in our key Argentina, Brazil, and Mexico markets, while re-launching AdeS in Colombia this year. Among our initiatives, we refreshed AdeS brand image, enhanced its client coverage and execution, and expanded its portfolio with our launch of almond and coconut dairy-alternative beverages for our consumers’ enjoyment. Thanks to our efforts, we extended AdeS’ footprint across our customer network and increased our share of the plant-based beverage category, particularly the fast-growing seed-based beverage segment.

“Thanks to our expanded client coverage, marketplace execution, and product innovation, we accelerated our volume growth in Santa Clara by 27% year over year across the modern and traditional trade channels.”

We continue to develop our innovative portfolio of still, sparkling, and flavored bottled water to rehydrate our consumers throughout their day.

In Panama, we reinforced our leadership position in the water category. To complement our personal water portfolio, we launched Dasani Fruit in our 600-ml PET presentation, coupled with Dasani mainstream water in our 355-ml PET presentation. Thanks to these and other initiatives, we increased our share of sales substantially across the personal water category.

In Argentina and Colombia, we implemented a three-tier strategy to differentiate our brands and better compete in the value, mainstream, and premium water segments. In Colombia’s value segment, we leveraged our Tai brand personal water through a new route-to-market to serve the country’s mom-and-pop customers. In Colombia’s mainstream segment, we continue to leverage our Brisa brand and we re-launched our Manatial brand water in the premium segment. In addition, in Argentina’s premium segment, we recently launched SmartWater. Overall, we achieved total personal water volume growth, excluding jug water, of more than 14% in Colombia, and we generated water volume growth of over 9% in Argentina.

Through our 360° strategic plan in Mexico, we strengthened our personal water portfolio while becoming a more robust player in this big beverage category. In the natural water segment, we achieved a major turnaround in our performance, significantly expanding our market share this year.  In the flavored water segment, we generated steady volume and market share growth throughout the year as we expanded our portfolio with the launch of attractive new flavors, including strawberry, coconut-raspberry, and pineapple-cucumber. In the mineral water segment, we achieved 5.5% volume growth driven by 45% volume growth of our iconic blue glass bottle of Ciel mineral water for Mexico’s on-premise and modern trade channels. Overall, in the Valley of Mexico, we expanded our personal water volume by 9% and significantly improved our market share year over year.

In the flavored water segment, we generated steady volume and market share growth throughout the year as we expanded our portfolio with the launch of attractive new flavors, including strawberry, coconut-raspberry, and pineapple-cucumber. In the mineral water segment, we achieved 5.5% volume growth driven by 45% volume growth of our iconic blue glass bottle of Ciel mineral water for Mexico’s on-premise and modern trade channels. Overall, in the Valley of Mexico, we expanded our personal water volume by 9% and significantly improved our market share year over year.

Consistent with our water strategy, we undertook a three-tier approach during the year. In the mainstream water segment, we focused on expanding the coverage of our Crystal brand 500-ml PET single-serve and 1.5-liter PET multi-serve presentations across the traditional and modern trade channels, respectively. In the upper mainstream flavored water segment, we built on our successful launch of naturally flavored Crystal sparkling water in personal 310-ml cans and 510-ml PET bottles, featuring lime, tangerine with lemongrass, and berry flavors. In the premium water segment, we recently launched SmartWater. Thanks to these initiatives, we achieved more than 13% volume growth, while significantly expanding our share of sales for the year.

4.8%

volume growth in

our personal water category

year over year

As leaders in the beverage industry, we continue to meet the changing lifestyles of our consumers and the communities we serve. We are taking specific, meaningful actions, driving the development of our low- or no- sugar portfolio across our markets ahead of consumer demand. We also strive to promote healthy habits in our communities through multi-sector coalitions and local initiatives focused on fostering healthy habits, proper nutrition, and physical activity.

We drive development of our no-sugar portfolio of beverages to satisfy and stimulate demand for our products ahead of consumer trends.

“With Coca‑Cola Sin Azúcar launched throughout our Mexican sales channels, we achieved double-digit volume growth, while steadily gaining market share throughout the year.”

In 2018, we consolidated the successful launch of one of our fastest growing sparkling beverage brands, Coca‑Cola Sin Azúcar, across our Mexican territories.  Coca‑Cola Sin Azúcar offers consumers a no-sugar alternative for one of the world’s most beloved brands. Launched throughout our Mexican sales channels, we achieved double-digit volume growth, while steadily gaining market share throughout the year. Correspondingly, we carried out a major rollout of our original Coca‑Cola recipe with less sugar in our family-size one-way presentations. Thanks to these and other initiatives, we nearly doubled our no- and low-sugar offering to 26% of our total Coca‑Cola portfolio mix, from 14% in 2017.

Coca‑Cola Sin Azúcar offers consumers a no-sugar alternative for one of the world’s most beloved brands. Launched throughout our Mexican sales channels, we achieved double-digit volume growth, while steadily gaining market share throughout the year. Correspondingly, we carried out a major rollout of our original Coca‑Cola recipe with less sugar in our family-size one-way presentations. Thanks to these and other initiatives, we nearly doubled our no- and low-sugar offering to 26% of our total Coca‑Cola portfolio mix, from 14% in 2017.

After we rebranded Coca‑Cola Sem Açúcar in August, our sales of this increasingly popular consumer choice grew dramatically across our Brazilian franchise territories. Driven by a combination of coverage, affordable convenient and multi-serve packaging, and a compelling digital campaign of influencers, we generated accelerating volume growth of almost 10% year over year, marked by double-digit volume growth in the fourth quarter of 2018.

Building on the growth of Coca‑Cola Sin Azúcares, we launched this popular brand in our 1.5-liter and 2-liter PET presentations across our Argentine territory. We also complemented this brand’s growth with our launch of our core Fanta and Sprite sparkling beverage brands without sugar in our 220-ml mini cans. By year-end 2018, our no-sugar offering reached 34% of our total sparkling beverage mix—the highest of our international franchise territories.

26%

of our colas portfolio

mix is low- and

no- sugar in Mexico

At Coca‑Cola FEMSA, our clients and consumers are at the center of our decisions and actions. Accordingly, transparency, fact-based information, and a high sense of responsibility are the guiding principles for our marketing practices.

To enable our consumers to make informed choices across every one of our operations, our up-front product labels include clear, easy-to-find nutritional content information, including the nutrients, fats, sugar, and sodium in each of our products. Our nutritional labeling strategy is based on recommended Dietary Daily Allowance Guidelines and on applicable regulations in each country. Given our geographic position in 10 countries, we understand that each population is different, with its own needs and habits. Therefore, we fully endorse and comply with each of our countries’ existing legal framework, as long as this framework clearly provides science-based information to our consumers. When regulatory changes arise, we are always willing to take part in such changes, providing our expertise as a system in order to ensure that our consumers are provided high-quality information.

As part of our commitment to the wellbeing of our consumers, our advertising adheres to The Coca‑Cola Company’s Responsible Marketing Policy and Global School Beverage Guidelines. For example, as part of The Coca‑Cola Company’s Responsible Marketing Policy, we diligently follow and enforce our policy not to target advertising of any products to children under the age of 12. We also push the industry to advertise responsibly, ensuring commercial-free classrooms. In this and other ways, we underscore our devotion to the healthy habits of our consumers.

Our production processes fulfill the highest quality standards; our ingredients comply with each of our operations’ local regulations and with the standards of other regulatory agencies, including CODEX, FDA, JECFA, and EFSA. Our processes are permanently performed in state-of-the-art bottling facilities within the global beverage industry, guaranteeing only the best quality products for our consumers.

To improve health issues that can affect the life quality of our communities, we must generate comprehensive solutions in collaboration with governments, the private sector, and civil society through multi-sector partnerships.

For the third consecutive year, we participated as a strategic partner in the Latin American Commitment for a Healthy Future, a multi-sector coalition with the Healthy Weight Commitment Foundation and other companies in the beverage industry. The coalition’s goal is to promote the execution of national initiatives that empower school-aged children and their families to make appropriate decisions about their dietary practices and physical activity to generate healthy habits through different educational tools.

To implement the Latin American Commitment for a Healthy Future initiative, we also collaborated with Discovery Education to deploy the Together Counts™ online educational platform. This platform offers a study plan based on health and wellbeing adapted to each stage of development, as well as interactive tools that consider the standards recommended by professional institutions to stimulate and build healthy habits.

The Latin American Commitment for a Healthy Future initiative and the Together Counts™ platform are currently active in Colombia, Mexico, and Brazil, benefiting more than 2.6 million people over the past three years.

We seek to encourage healthy habits in our communities through local programs focused on nutrition and physical activity.

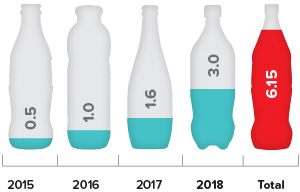

Among our goals, we aim to benefit 5 million people through our healthy habits and nutrition programs from 2015 to 2020. At the end of 2018, we exceeded our goal with approximately 6.15 million people benefiting from our programs over the past four years.

To achieve this goal, over the past 10 years, we have made strategic social investments in projects—with a strong education component—focused on fostering healthy habits in our communities.

Along with the Coca‑Cola System and other partners, we collaborate in the Ponte al 100 program—designed to generate healthy habits in elementary school students, while providing metabolic index measurement of different health indicators for a large portion of the population. Thanks to this program, we have positively improved the wellbeing of our communities.

We improve our communities’ quality of life through Praça da Cidadania. This initiative provides access to public services—including tests for breast cancer, diabetes, and hypertension—while building a network of upgraded community health, nutrition, and physical activity programs.

We contribute to the physical activity of children, teenagers, and adults through their participation in the Hora de Moverse initiative, which promotes teacher training and donates sports equipment.

The goal of Coca‑Cola FEMSA’s Red de Entrenadores is to develop leaders who encourage communal living, inclusion, and gender equality through sports. The instructors received theoretical and practical training based on the Sports for Development methodology to promote peaceful, harmonious coexistence in their communities.

Vive Bailando. This social intervention model focuses on teenagers, using dance classes as a transformative healthy lifestyles tool that provides a positive, sustainable impact on their behavior, leadership, family unit, and ability to change surroundings that have been affected by violence.

We support Campaña de Colores, a network that promotes nutrition and healthy habits at 65 elementary schools in Costa Rica, Guatemala, Nicaragua, and Panama, by educating children about nutrition, hygiene, and positive physical activity habits. This project is carried out in collaboration with the American Nicaraguan Foundation (ANF) and Glasswing International.

Partnering with The Coca‑Cola Company, we offer the Un Plato, Una Sonrisa program to contribute to academic performance, promote balanced eating habits, and maintain nutritional wellbeing by supplying daily meals throughout the school year.