We celebrated the 25th anniversary of our company’s incorporation and stock exchange listing—an entrepreneurial story of consistent growth, innovation, and value creation.

José Antonio Fernández Carbajal

John Santa Maria Otazua

We’ve grown from a Mexico-based bottler to a multinational, multi-category beverage leader, serving 290 million people and 2 million points of sale through 48 plants and 297 distribution centers across 10 countries. We’ve re-invested over US$20 billion in our business, including US$11.4 billion in accretive mergers and acquisitions.

Our entrepreneurial spirit and passion for our consumers and clients powered our drive for growth and innovation. Leading the way, we served the market through our transformative practices—from revenue growth management to segmented point-of-sale execution, to cold drink equipment placement, and end-to-end supply chain integration.

Impressively, our company multiplied the original value of our business by almost 13 times—from US$1 billion at our IPO to US$12.8 billion today—delivering an annual total shareholder return of over 19.2% since 1993.

Consistent with our disciplined approach to capital allocation—focused on driving shareholder returns—and the recent evolution of the Philippines’ business outlook, our Board of Directors concluded that exercising our put option and selling our 51% stake in Coca-Cola FEMSA Philippines, Inc., represented the best course of action for our company’s stakeholders. This very difficult decision came after a successful five-year turnaround of this operation.

We continued to capitalize on strategic, long-term synergetic opportunities through the acquisitions of the ABASA, Los Volcanes, and MONRESA franchises in Guatemala and Uruguay, serving an additional 14.6 million people. Looking forward, we will continually evaluate geographical and category opportunities, maintaining our disciplined approach to capital allocation to maximize shareholder returns.

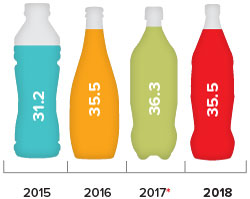

Operating cash flow = operating income + depreciation + amortization & other operative non-cash charges

* 2017 financial information is re-presented as if the Philippines had been discontinued from February 2017, date of the consolidation of said operation.

“Our company multiplied the original value of our business by almost 13 times—from US$1 billion at our IPO to US$12.8 billion today.”

Clear Integrated Value Creation Model

Our consumers and clients are at the center of everything we do. Accordingly, we’re building a winning portfolio for each market—marked by 237 launches this year. Capitalizing on brand Coca-Cola, we’re leveraging our sparkling beverage category’s growth through an affordable mix of returnable and convenient, smaller presentations at magic price points for our consumers. We’re also driving our low- or no- sugar portfolio ahead of consumer trends, nearly doubling our low- or no- sugar offering in Mexico.

With our launch of SmartWater in Brazil and Argentina, we’re establishing a consistent leadership position in water, amplifying our premium, mainstream, and value water portfolio.

We’re selectively improving our competitive position in the still beverage category, exemplified by our redesigned Brazilian juice portfolio. We’re accelerating our dairy category’s growth through Santa Clara, while consolidating our position in the plant-based beverage category under AdeS—expanding our portfolio with the launch of almond and coconut beverages.

Also we’re accelerating our digitally driven business transformation. Our vision is to deploy a demand-driven end-to-end integrated supply chain platform, utilizing advanced analytics, big data, and artificial intelligence to granularly serve our clients and consumers. We further look to capture the analytical insights we gain from our comprehensive sales and marketing platform to design tailored business models that maximize and capture customer value creation for each segment.

Consistent with our consumer and client-centric cultural evolution, we defined KOF DNA—core beliefs and behaviors that we aspire to live daily. KOF DNA will enable us to better work together to achieve our business results, while becoming a total beverage leader aligned with our consumers’ tastes and lifestyles.

We’re responsibly addressing environmental and social challenges across our operations’ value chain. Aligned with The Coca-Cola Company’s “World Without Waste” global initiative, we used 21% of recycled materials in our PET packaging, on track to achieve our 2020 goal of 25%. We also covered 50% of our manufacturing operations’ power needs with clean energy; improved our overall water use ratio by 19% over the past 8 years to 1.59 liters of water per liter of beverage produced; and surpassed our 2020 goal of benefiting 5 million people through our healthy habits initiatives.

Consistent Transformation: Operating Highlights

Guided by our clear strategy, we navigated a complex environment to deliver positive comparable1 results this year. Our comparable sales volume increased 1.3% to 3.09 billion unit cases, with transactions growing 1.4% to 18.4 billion. Comparable total revenues grew 5.9% to Ps. 168.6 billion. Comparable operating income grew 0.9% to Ps. 23.0 billion. Comparable operating cash flow grew 3.8% to Ps. 32.8 billion. Importantly, our reported net controlling interest income reached Ps. 13.9 billion for earnings per share of Ps. 6.62 (Ps. 66.21 per ADS).

| 1 | Excluding the effects of: mergers, acquisitions, and divestitures; exchange rate movements; and hyperinflationary economies such as Argentina and Venezuela; and presenting Coca-Cola FEMSA Philippines, Inc., as a discontinued operation as of January 1, 2018, and the consolidated income statements are re-presented as if the Philippines had been discontinued from February 2017, date of the consolidation of said operation. |

“We’re accelerating our digitally driven business transformation. Our vision is to deploy a demand-driven end-to-end integrated supply chain platform, utilizing advanced analytics, big data, and artificial intelligence to granularly serve our clients and consumers.”

| 1 | Excluding the effects of: mergers, acquisitions, and divestitures; exchange rate movements; and hyperinflationary economies such as Argentina and Venezuela; and presenting Coca-Cola FEMSA Philippines, Inc., as a discontinued operation as of January 1, 2018, and the consolidated income statements are re-presented as if the Philippines had been discontinued from February 2017, date of the consolidation of said operation. |

In Mexico, we maintained market share, delivering positive top-line results in the face of macroeconomic uncertainty and currency volatility. With regard to profitability, our pricing, currency hedging, and cost and expense control strategies—coupled with our digital initiatives—mitigated significant raw material cost pressures.

In Central America, we leveraged our portfolio of affordable presentations to continue our turnaround in Costa Rica and Guatemala, while improving Panama’s top-line growth. The consolidation of new territories and our successful pre-sale model rollout enabled us to achieve outstanding volume growth in Guatemala.

Emerging from a tough macroeconomic environment in Brazil, we delivered consistent volume growth for the year.

Leveraging our affordability strategy, our portfolio is well positioned to satisfy Brazil’s recovering consumer environment. Our digital capabilities, along with favorable sugar costs and attractively hedged prices, produced profitability improvements for the year.

Led by our affordability strategy, we improved our volumes in the face of Colombia’s challenging, gradually recovering consumer environment. Confronting Argentina’s tough macroeconomic environment marked by hyperinflation, we are much better prepared for this market’s challenges thanks to our growing mix of affordable packages and no-sugar beverages, digital initiatives, currency hedging, and cost and expense controls. In Venezuela, we continually adjust our business model to serve our consumers and clients.

Moving forward, we will focus on seven strategic priorities: leverage sparkling beverage growth through affordability; establish a consistent leadership position in water; selectively improve our competitive position in still beverages; drive our low- or no- sugar footprint; develop tailored business models for customer segments; accelerate our digitally driven business transformation; and create a more collaborative, consumer and client-centric culture.

On behalf of our employees, we thank you for your continued confidence in our ability to deliver economic, social, and environmental value for you all.

José Antonio Fernández Carbajal

Chairman of the Board

John Santa Maria Otazua

Chief Executive Officer

“We continue to capitalize long-term synergetic opportunities through the acquisitions of the ABASA, Los Volcanes, and MONRESA franchises in Guatemala and Uruguay.”

We’ve

re-invested over

US$20

billion in

our business