financial summary

Amounts expressed in millions of U.S. dollars and Mexican pesos, except data per share and headcount.

| U.S. (*) | 2020 | 2019 | 2018 (4) (5) (6) | 2017 (2) (3) (4) | 2016 (1) | |

|---|---|---|---|---|---|---|

| INCOME STATEMENT | ||||||

| Total revenues |

9,231 |

183,615 |

194,471 |

182,342 |

183,256 |

177,718 |

| Cost of goods solds |

5,068 |

100,804 |

106,964 |

98,404 |

99,748 |

98,056 |

| Gross profit |

4,163 |

82,811 |

87,507 |

83,938 |

83,508 |

79,662 |

| Operative expenses |

2,838 |

56,444 |

60,537 |

57,924 |

58,044 |

55,462 |

| Other expenses, net |

182 |

3,611 |

2,490 |

1,881 |

31,357 |

3,812 |

| Comprehensive financing result |

336 |

6,678 |

6,071 |

6,943 |

5,362 |

6,080 |

|

Income before income taxes and share of the profit or of associates and joint ventures accounted for using the equity method |

808 |

16,077 |

18,409 |

17,190 |

(11,255) |

14,308 |

| Income taxes |

273 |

5,428 |

5,648 |

5,260 |

4,184 |

3,928 |

| Share in the (loss) profit of equity accounted investees, net of taxes |

(14) |

(281) |

(131) |

(226) |

60 |

147 |

| Consolidated net income |

521 |

10,368 |

12,630 |

15,070 |

(11,654) |

10,527 |

| Equity holders of the parent |

518 |

10,307 |

12,101 |

10,936 |

(16,058) |

10,070 |

| Non-controlling interest net income |

3 |

61 |

529 |

768 |

679 |

457 |

| RATIOS TO REVENUES (%) | ||||||

| Gross margin |

45.1 |

45.1 |

45.0 |

46.0 |

45.6 |

44.8 |

| Net income margin |

5.6 |

5.6 |

6.5 |

8.3 |

(6.4) |

5.9 |

| CASH FLOW | ||||||

| Operative cash flow |

1,767 |

35,147 |

31,289 |

29,687 |

33,236 |

32,446 |

| Capital expenditures (7) |

521 |

10,354 |

11,465 |

11,069 |

14,612 |

12,391 |

| Total cash, cash equivalents |

2,187 |

43,497 |

20,491 |

23,727 |

18,767 |

10,476 |

| BALANCE SHEET | ||||||

| Current assets |

3,642 |

72,440 |

56,796 |

57,490 |

55,657 |

45,453 |

| Investment in shares |

383 |

7,623 |

9,751 |

10,518 |

12,540 |

22,357 |

| Property, plant and equipment, net |

2,989 |

59,460 |

61,187 |

61,942 |

75,827 |

65,288 |

| Intangible assets, net |

5,227 |

103,971 |

112,050 |

116,804 |

124,243 |

123,964 |

| Deferred charges and other assets, net |

920 |

18,294 |

16,673 |

17,033 |

17,410 |

22,194 |

| Total Assets |

13,225 |

263,066 |

257,839 |

263,787 |

285,677 |

279,256 |

| Liabilities | ||||||

| Short-term bank loans and notes payable |

253 |

5,017 |

11,485 |

11,604 |

12,171 |

3,052 |

| Interest payable |

36 |

712 |

439 |

497 |

487 |

520 |

| Other current liabilities |

1,865 |

37,116 |

39,086 |

33,423 |

42,936 |

36,296 |

| Long-term bank loans and notes payable |

4,145 |

82,461 |

58,492 |

70,201 |

71,189 |

85,857 |

| Other long-term liabilities |

770 |

15,303 |

18,652 |

16,312 |

18,184 |

24,298 |

| Total Liabilities |

7,069 |

140,609 |

128,154 |

132,037 |

144,967 |

150,023 |

| Equity |

6,156 |

122,457 |

129,685 |

131,750 |

140,710 |

129,233 |

| Non-controlling interest in consolidated subsidiaries |

281 |

5,583 |

6,751 |

6,806 |

18,141 |

7,096 |

| Equity attributable to equity holders of the parent |

5,875 |

116,874 |

122,934 |

124,944 |

122,569 |

122,137 |

| FINANCIAL RATIOS (%) | ||||||

| Current |

1.69 |

1.69 |

1.11 |

1.26 |

1.00 |

1.14 |

| Leverage |

1.15 |

1.15 |

0.99 |

1.00 |

1.03 |

1.16 |

| Capitalization |

0.43 |

0.43 |

0.37 |

0.41 |

0.39 |

0.41 |

| Coverage |

5.13 |

5.13 |

5.51 |

4.22 |

4.20 |

4.80 |

| DATA PER SHARE | ||||||

| Book Value (8) |

0.350 |

6.954 |

7.315 |

7.434 |

7.293 |

7.365 |

| Loss (income) tributable to the holders of the parent (9) |

0.030 |

0.610 |

0.723 |

0.831 |

(0.765) |

0.607 |

| Dividends paid (10) |

0.031 |

0.608 |

0.443 |

0.419 |

0.422 |

0.419 |

| Headcount (11) |

82,334 |

82,334 |

82,186 |

83,364 |

79,636 |

85,140 |

Information considers full-year of KOF’s territories and one month of Vonpar Refrescos, S.A. ("Vonpar").

Income statement information considers full-year of KOF’s territories and full-year of Coca-Cola FEMSA Venezuela.

Balance sheet information does not include Coca-Cola FEMSA Venezuela's balances due to deconsolidation as of December 31, 2017.Coca-Cola FEMSA Venezuela balance is included as investement in shares as of December 31, 2017.

KOF Philippines has been classified as a discontinued operation in our profit and loss statement for the years ended December 31, 2017 and 2018.

Income statement information includes 8 months of the financial results for Abasa and Los Volcanes in Guatemala.

Income statement information includes six months in the financial results for Uruguay.

Includes investments in property, plant and equipment, refrigeration equipment and returnable bottles and cases, net of disposals of property, plant and equipment.

Based on 16,806.7 million ordinary shares as of December 31, 2020, 2019, 2018 and 2017, and 16,583.4 million shares as of December 31, 2016.

Computed based on the weighted average number of shares outstanding during the periods presented:16,806.7 million for 2020, 2019 and 2018, 16,730.8 million in 2017 and 16,730.8 million in 2016.

Dividends paid during the year based on the prior year's net income, using 16,806.7 millions outstanding ordinary shares for 2020, 2019 and 2018 and 16,583.4 million oustanding ordinary shares for paid on 2017 and 2016.

Includes third-party and for 2017 excludes 16,566 employees for our discontinued operation in Phillipines.

* Exchange rate as of December 31, 2020 Ps. 19.89 per U.S. dollar solely for the convenience of the reader according to the federal USA reserve.

management discussion & analysis

Results for the Year Ended December 31, 2020

Compared to the Year Ended December 31, 2019

Consolidated Results

The comparability of our financial and operating performance in 2020 as compared to 2019 was affected by the following factors: (1) translation effects from fluctuations in exchange rates; and (2) our results in Argentina, which since January 1, 2018 has been considered a hyperinflationary economy. For the convenience of the reader, we have included a discussion of the financial information below on a comparable basis, excluding the translation effects from fluctuations in exchange rates. To translate the full-year results of Argentina for the years ended December 31, 2020 and 2019, we used the exchange rate at December 31, 2020 of 84.15 Argentine pesos per U.S. dollar and the exchange rate at December 31, 2019 of 59.89 Argentine pesos per U.S. dollar, respectively. The depreciation of the exchange rate of the Argentine peso at December 31, 2020, as compared to the exchange rate at December 31, 2019, was 40.5%. In addition, the average depreciation of currencies used in our main operations relative to the U.S. dollar in 2020, as compared to 2019, were: 11.6% for the Mexican peso, 30.7% for the Brazilian real, and 12.6% for the Colombian peso.

Total Revenues. Our consolidated total revenues decreased by 5.6% to Ps.183,615 million in 2020 as compared to 2019, mainly as a result of unfavorable price-mix effects due to the COVID-19 pandemic and currency translation effects resulting from the depreciation of all of our operating currencies in South America against the Mexican peso, particularly the Brazilian real, which had a 14.5% unfavorable translation effect. These effects were partially offset by favorable pricing and revenue management initiatives. Total revenues include other operating revenues related to entitlements to reclaim tax payments in Brazil in 2020. See Note 25.2.1 to our consolidated financial statements. On a comparable basis, total revenues would have decreased by 1.0% in 2020 as compared to 2019.

Total sales volume decreased by 2.5% to 3,284.4 million unit cases in 2020 as compared to 2019, mainly as a result of social distancing and other measures adopted as a result of the COVID-19 pandemic, which had an adverse effect on our points of sale.

In 2020, sales volume of our sparkling beverage portfolio decreased by 1.1%, sales volume of our colas portfolio decreased by 0.2%, and sales volume of our flavored sparkling beverage portfolio decreased by 5.0%, in each case as compared to 2019.

Sales volume of our still beverage portfolio decreased by 5.0% in 2020 as compared to 2019.

Sales volume of our bottled water category, excluding bulk water, decreased by 22.6% in 2020 as compared to 2019.

Sales volume of our bulk water category increased by 0.6% in 2020 as compared to 2019.

Consolidated average price per unit case decreased by 3.5% to Ps.50.63 in 2020, as compared to Ps. 52.46 in 2019, mainly as a result of unfavorable price-mix effects and the negative translation effect resulting from the depreciation of most of our operating currencies relative to the Mexican peso. This was partially offset by price increases aligned with or above inflation. On a comparable basis, average price per unit case would have remained flat at 0.3% in 2020 as compared to 2019, driven by our revenue management and pricing initiatives.

Gross Profit. Our gross profit decreased by 5.4% to Ps.82,811 million in 2020 as compared to 2019; with a gross margin increase of 10 basis points as compared to 2019 to reach 45.1% in 2020. This gross margin increase was mainly driven by our pricing initiatives, together with lower PET resin costs and stable sweetener prices in most of our operations, which were partially offset by higher concentrate costs in Mexico, higher concentrate costs in Brazil due to the reduction of tax credits on concentrate purchased from the Manaus Free Trade Zone, coupled with our decision to suspend such tax credits, and the depreciation in the average exchange rate of most of our operating currencies as applied to U.S. dollar-denominated raw material costs. On a comparable basis, our gross profit would have decreased by 1.3% in 2020 as compared to 2019.

The components of cost of goods sold include raw materials (principally concentrate, sweeteners and packaging materials), depreciation costs attributable to our production facilities, wages and other labor costs associated with labor force employed at our production facilities and certain overhead costs. Concentrate prices are determined as a percentage of the retail price of our products in local currency, net of applicable taxes. Packaging materials, mainly PET resin and aluminum, and HFCS, used as a sweetener in some countries, are denominated in U.S. dollars.

Administrative and Selling Expenses. Our administrative and selling expenses decreased by 6.8% to Ps.56,444 million in 2020 as compared to 2019. Our administrative and selling expenses as a percentage of total revenues decreased by 40 basis points to 30.7% in 2020 as compared to 2019, mainly as a result of operating expense efficiencies in labor, maintenance and marketing. In 2020, we continued investing across our territories to support marketplace execution, increase our cooler coverage, and bolster our returnable presentation base.

Other Expenses Net. We recorded other expenses net of Ps.3,611 million in 2020 as compared to Ps.2,490 million in 2019, which increase was mainly as a result of an extraordinary other operating expenses related to impairments in Estrella Azul in Panama and in Leão Alimentos, our non-carbonated beverage associate in Brazil, which were partially offset by the implementation of our efficiency program to create a leaner and more agile organization. For more information, see Note 10 to our consolidated financial statements.

Comprehensive Financing Result. he term “comprehensive financing result” refers to the combined financial effects of net interest expenses, net financial foreign exchange gains or losses, and net gains or losses on the monetary position of hyperinflationary countries where we operate. Net financial foreign exchange gains or losses represent the impact of changes in foreign exchange rates on financial assets or liabilities denominated in currencies other than local currencies, and certain gains or losses resulting from derivative financial instruments. A financial foreign exchange loss arises if a liability is denominated in a foreign currency that appreciates relative to the local currency between the date the liability is incurred and the date it is repaid, as the appreciation of the foreign currency results in an increase in the amount of local currency, which must be exchanged to repay the specified amount of the foreign currency liability.

Comprehensive financing result in 2020 recorded an expense of Ps.6,678 million as compared to an expense of Ps.6,071 million in 2019. This 10.0% increase was mainly driven by a one-time interest expense related to the repurchase and redemption in full of our 3.875% senior notes due 2023. In addition, we incurred short-term financing as a preventive measure to reinforce our cash position. These effects were partially offset by debt prepayments.

Income Taxes. In 2020, our effective income tax rate was 33.8%, reaching Ps.5,428 million in 2020, as compared to Ps.5,648 million in 2019. Our effective income tax rate increased in 2020 as compared to 2019 as a result of impairments of approximately Ps.2,349 million recognized during the period and an increase in income credit taxes. For more information, see Note 25 to our consolidated financial statements.

Share in the Loss of Equity Accounted Investees, Net of Taxes. In 2020, we recorded a loss of Ps.281 million in the share in the loss of equity accounted investees, net of taxes, mainly due to the results of Leão Alimentos, our associate in Brazil, and Estrella Azul in Panama.

Net Income (Equity holders of the parent). We reported a net controlling interest income of Ps.10,307 million in 2020, as compared to Ps.12,101 million in 2019. This 14.8% decrease was mainly driven by lock-downs and social distancing measures related to the COVID-19 pandemic coupled with impairments on equity method investees recognized during the year, which were partially offset by our cost saving, revenue management and pricing initiatives.

Results by Consolidated Reporting Segment

Mexico and Central America

Total Revenues. Total revenues in our Mexico and Central America consolidated reporting segment decreased by 2.3% to Ps.106,783 million in 2020 as compared to 2019, mainly as a result of a volume decline in Mexico coupled with unfavorable price-mix effects across our markets.

Total sales volume in our Mexico and Central America consolidated reporting segment decreased by 4.0% to 1,991.6 million unit cases in 2020 as compared to 2019, as a result of mobility restrictions and social distancing measures related to the COVID-19 pandemic.

Sales volume of our sparkling beverage portfolio decreased 3.7% in 2020 as compared to 2019, driven by a decline in our colas and flavored sparkling beverage portfolio.

Sales volume of our still beverage portfolio decreased by 6.7% in 2020 as compared to 2019, due to declines in sales volume in both Mexico and Central America.

Sales volume of bottled water, excluding bulk water, decreased by 26.5% in 2020 as compared to 2019, due to declines in sales volume in both Mexico and Central America.

Sales volume of our bulk water portfolio remained flat in 2020 as compared to 2019.

Sales volume in Mexico decreased by 4.3% to 1,759.2 million unit cases in 2020, as compared to 1,838.3 million unit cases in 2019, mainly as a result of mobility restrictions and social distancing measures related to the COVID-19 pandemic.

Sales volume of our sparkling beverage portfolio decreased in 2020 as compared to 2019, driven by a decline in our colas and flavored sparkling beverage portfolio.

Sales volume of our still beverage portfolio decreased by 4.9% in 2020 as compared to 2019.

Sales volume of bottled water, excluding bulk water, decreased by 26.0% in 2020 as compared to 2019.

Sales volume of our bulk water portfolio increased by 0.5% in 2020 as compared to 2019.

Sales volume in Central America decreased by 1.9% to 232.4 million unit cases in 2020, as compared to 236.9 million unit cases in 2019, mainly as a result of mobility restrictions and social distancing measures related to the COVID-19 pandemic.

Sales volume of our sparkling beverage portfolio increased by 1.3% in 2020 as compared to 2019, driven by a 3.4% increase in colas.

Sales volume of our still beverage portfolio decreased by 16.8% in 2020 as compared to 2019.

Sales volume of bottled water, excluding bulk water, decreased by 29.9% in 2020 as compared to 2019.

Sales volume of our bulk water portfolio declined by 20.9% in 2020 as compared to 2019.

Gross Profit. Our gross profit in this consolidated reporting segment increased by 1.0% to Ps.52,906 million in 2020 as compared to 2019 and gross profit margin increased by 160 basis points to 49.5% in 2020 as compared to 2019. Gross profit margin increased mainly as a result of our pricing initiatives, cost efficiencies and lower PET costs, coupled with our raw material and currency hedging strategies. These factors were partially offset by unfavorable price-mix effects, higher concentrate costs in Mexico and the depreciation in the average exchange rate of most of our operating currencies as applied to our U.S. dollar-denominated raw material costs.

Administrative and Selling Expenses. Administrative and selling expenses as a percentage of total revenues in this consolidated reporting segment decreased by 50 basis points to 32.4% in 2020 as compared to the same period in 2019. Administrative and selling expenses, in absolute terms, decreased by 3.5% in 2020 as compared to 2019 driven mainly by our ability to drive savings and operating expense efficiencies primarily in labor, maintenance and marketing in Mexico.

South America

Total Revenues. Total revenues in our South America consolidated reporting segment decreased by 9.8% to Ps.76,831 million in 2020 as compared to 2019, mainly as a result of unfavorable price-mix and currency translation effects resulting from the depreciation of most of our operating currencies as compared to the Mexican peso. This figure includes other operating revenues related to entitlements to reclaim tax payments in Brazil in 2020. See Note 25.2.1 to our consolidated financial statements. Total revenues for beer amounted to Ps.15,228 million in 2020. On a comparable basis, total revenues would have increased by 3.6% in 2020 as compared to 2019.

Total sales volume in our South America consolidated reporting segment remained stable at 1,292.7 million unit cases in 2020 as compared to 2019, mainly as a result of volume growth in Brazil.

Sales volume of our sparkling beverage portfolio increased by 1.6% in 2020 as compared to 2019.

Sales volume of our still beverage portfolio decreased by 1.9% in 2020 as compared to 2019.

Sales volume of our bottled water category, excluding bulk water, decreased by 18.3% in 2020 as compared to 2019.

Sales volume of our bulk water portfolio increased by 2.5% in 2020 as compared to 2019.

Sales volume in Brazil increased by 1.9% to 862.9 million unit cases in 2020, as compared to 846.5 million unit cases in 2019.

Sales volume of our sparkling beverage portfolio increased by 2.8% in 2020 as compared to 2019, as a result of growth in our colas and flavored sparkling beverage portfolio.

Sales volume of our still beverage portfolio decreased by 1.2% in 2020 as compared to 2019.

Sales volume of our bottled water, excluding bulk water, decreased by 9.4% in 2020 as compared to 2019.

Sales volume of our bulk water portfolio increased by 18.8% in 2020 as compared to 2019.

Sales volume in Colombia decreased by 4.0% to 254.8 million unit cases in 2020, as compared to 265.5 million unit cases in 2019.

Sales volume of our sparkling beverage portfolio increased by 0.9% in 2020 as compared to 2019, mainly driven by growth in our flavored sparkling beverage portfolio.

Sales volume of our still beverage portfolio decreased by 8.7% in 2020 as compared to 2019.

Sales volume of bottled water, excluding bulk water, decreased by 33.8% in 2020 as compared to 2019.

Sales volume of our bulk water portfolio decreased by 13.7% in 2020 as compared to 2019.

Sales volume in Argentina decreased by 3.9% to 133.8 million unit cases in 2020, as compared to 139.3 million unit cases in 2019.

Sales volume of our sparkling beverage portfolio decreased by 2.8% in 2020 as compared to 2019, mainly impacted by a decline in our flavored sparkling beverage portfolio.

Sales volume of our still beverage portfolio increased by 3.5% in 2020 as compared to 2019.

Sales volume of bottled water, excluding bulk water, decreased by 32.0% in 2020 as compared to 2019.

Sales volume of our bulk water portfolio increased by 48.4% in 2020 as compared to 2019.

Sales volume in Uruguay decreased by 2.8% to 41.2 million unit cases in 2020, as compared to 42.4 million unit cases in 2020.

Sales volume of our sparkling beverage portfolio decreased by 5.1% in 2020 as compared to 2019.

Sales volume of our still beverage portfolio increased by 36.2% in 2020 as compared to 2019.

Sales volume of bottled water increased by 18.0% in 2020 as compared to 2019.

Gross Profit. Gross profit in this consolidated reporting segment amounted to Ps.29,905 million, a decrease of 14.9% in 2020 as compared to 2019, with a 230 basis point margin contraction to 38.9%. This decrease in gross profit was mainly driven by an unfavorable price-mix effect and the depreciation of the average exchange rate of all of our operating currencies in the division as applied to our U.S. dollar-denominated raw material costs. These factors were partially offset by lower PET costs and our revenue management initiatives.

Administrative and Selling Expenses. Administrative and selling expenses as a percentage of total revenues in this consolidated reporting segment decreased by 50 basis points to 28.4% in 2020 as compared to 2019 driven mainly by operating expense efficiencies in Brazil. Administrative and selling expenses, in absolute terms, decreased by 11.5% in 2020 as compared to 2019.

Comprehensive risk management

Our company is present in different countries and regions. Consequently, we are continually exposed to an environment that presents challenges and risks. Our ability to manage the risks that may arise in the global environment where we operate is vital for our business’ value creation. Accordingly, our strategy includes a Comprehensive Risk Management Process through which we are able to identify, measure, register, assess, prevent, and/or mitigate risks.

Capital & Company Engagement

corporate governance

Executive Officers

John Santa Maria Otazua

Chief Executive Officer

Constantino Spas Montesinos

Chief Financial Officer

Karina Paola Awad Pérez

Human Resources Officer

José Ramón Martínez

Corporate Affairs Officer

Rafael Ramos Casas

Supply Chain and Engineering Officer

Rafael Alberto Suárez Olaguíbel¹

Information Technology and Commercial Officer

Fabricio Ponce García

Chief Operating Officer – Mexico

Ian M. Craig García

Chief Operating Officer - Brazil

Eduardo G. Hernández Peña

Chief Operating Officer - LATAM

Xiemar Zarazua López

Commercial Development Officer

board of directors

Directors Appointed by Series a Shareholders

José Antonio Fernández Carbajal

Executive Chairman of the Board of Directors of FEMSA

28 years as a Board Member

Federico José Reyes García

Independent Consultant

28 years as a Board Member

Alternate: Javier Gerardo Astaburuaga Sanjines

John Santa Maria Otazua

Chief Executive Officer of Coca-Cola FEMSA

7 years as a Board Member

Ricardo Guajardo Touché²

Chairman of the Board of Directors of SOLFI, S.A. de C.V.

28 years as a Board Member

Enrique F. Senior Hernández²

Managing Director of Allen & Company, LLC.

17 years as a Board Member

Eduardo Padilla Silva

Chief Executive Officer of FEMSA

5 years as a Board Member

Luis Rubio Freidberg²

President of the Board of Directors of México Evalúa

6 years as a Board Member

Alternate: Jaime A. El Koury

Daniel Servitje Montull²

Chief Executive Officer and Chairman of the Board of Directors of Bimbo

23 years as a Board Member

José Luis Cutrale

Chairman of the Board of Directors of Sucocítrico Cutrale, LTDA.

17 years as a Board Member

Alternate: José Henrique Cutrale

Luis Alfonso Nicolau Gutiérrez²

Partner at Ritch, Mueller, Heather y Nicolau, S.C., Law Firm; Member of the Firm´s Executive Committee

3 years as a Board Member

Directors Appointed by Series D Shareholders

José Octavio Reyes Lagunes

Retired

5 years as a Board Member

Alternate: Theresa Robin Rodgers Moore

John Murphy

Executive Vice President and Chief Financial Officer of The Coca-Cola Company

2 years as a Board Member

Alternate: Sunil Krishna Ghatnekar

Charles H. McTier²

Retired

23 years as a Board Member

James Leonard Dinkins

Senior Vice President of The Coca-Cola Company and President of Coca-Cola North America (CCNA)

1 year as a Board Member

Alternate:Marie D. Quintero-Johnson

Directors Appointed by Series L Shareholders

Víctor Alberto Tiburcio Celorio²

Independent Consultant

3 years as a Board Member

Francisco Zambrano Rodríguez²

Managing Partner of Forte Estate Plannning S.C.

18 years as a Board Member

Alfonso González Migoya²

Business consultant and Managing Partner of Acumen Empresarial, S.A. de C.V.

15 years as a Board Member

Secretary of Board

Carlos Eduardo Aldrete Ancira

General Counsel of FEMSA

27 years as a Secretary

Alternate: Carlos Luis Díaz Sáenz

As of January 1, 2021, Mr. Ignacio Echevarria assumed the position of Chief Information Officer, reporting directly to our CEO. Mr. Echevarria assumed the IT responsibilities that were previously overseen by Mr. Suárez, who will continue to focus his role in transformation and commercial development.

Independent

Board of practices

Planning and Finance Committee

The Planning and Finance Committee works with management to set our annual and long-term strategic and financial plans and monitors adherence to these plans. It is responsible for setting our optimal capital structure and recommends the appropriate level of borrowing as well as the issuance of securities. Financial risk management is another responsibility of the Planning and Finance Committee. Ricardo Guajardo Touché is the chairman of the Planning and Finance Committee. The other members include: Federico Reyes García, John Murphy, Enrique F. Senior Hernández and Miguel Eduardo Padilla Silva. The secretary non-member of the Planning and Finance Committee is Constantino Spas Montesinos, our Chief Financial Officer.

Audit Committee

The Audit Committee is responsible for reviewing the accuracy and integrity of quarterly and annual financial statements in accordance with accounting, internal control and auditing requirements. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the independent auditor, who reports directly to the Audit Committee (such appointment and compensation being subject to the approval of our board of directors); the internal auditing function also reports to the Audit Committee. The Audit Committee has implemented procedures for receiving, retaining and addressing complaints regarding accounting, internal control and auditing matters, including the submission of confidential, anonymous complaints from employees regarding questionable accounting or auditing matters. To carry out its duties, the Audit Committee may hire independent counsel and other advisors. As necessary, we compensate the independent auditor and any outside advisor hired by the Audit Committee and provide funding for ordinary administrative expenses incurred by the Audit Committee in the course of its duties. Victor Alberto Tiburcio Celorio is the chairman of the Audit Committee and the “audit committee financial expert.” Pursuant to the Mexican Securities Market Law, the chairman of the Audit Committee is elected at our shareholders meeting. The other members are: Alfonso González Migoya, Charles H. McTier and Francisco Zambrano Rodríguez. Each member of the Audit Committee is an independent director, as required by the Mexican Securities Market Law and applicable New York Stock Exchange listing standards. The secretary non-member of the Audit Committee is José González Ornelas, vice-president of FEMSA’s internal corporate control department.

Corporate Practices Committee

The Corporate Practices Committee, which consists exclusively of independent directors, is responsible for preventing or reducing the risk of performing operations that could damage the value of our company or that benefit a particular group of shareholders. The committee may call a shareholders meeting and include matters on the agenda for that meeting that it deems appropriate, approve policies on related party transactions, approve the compensation plan of the chief executive officer and relevant officers, and support our board of directors in the elaboration of related reports. The chairman of the Corporate Practices Committee is Daniel Javier Servitje Montull. Pursuant to the Mexican Securities Market Law, the chairman of the Corporate Practices Committee is elected at our shareholders meeting. The other members include: Jaime A. El Koury, Luis Rubio Freidberg, Luis A. Nicolau Gutiérrez, and two permanent non-member guests, Miguel Eduardo Padilla Silva and José Octavio Reyes Lagunes. The secretary non-member of the Corporate Practices Committee is Karina Paola Awad Pérez, our Human Resources Officer.

integral ethical system

Through our ethical culture, we manage under schemes that must be adopted as a way of life that inspires the acts and actions of all those who are part of the organization through the establishment of an Ethical System.

Our ethical management is based on:

Prevent illicit behaviors that may affect our human capital and our heritage.

Detect improper acts through open communication channels.

Respond and provide feedback to our organization to build trust.

Therefore, our system is comprised of three fundamental elements: the Code of Ethics, an Ethics Committee and the whistleblowing system known as KOF Ethics Line.

Our Code of Ethics

It is the basis of our organizational culture, communicates our values, contemplates our main behaviors, promotes good behavior inside and outside our organization and guides our correct decision-making based on ethical principles. Our Code, recently updated, includes important topics such as Human Rights, Inclusion and Diversity, Discrimination, Violence and Harassment, Conflicts of interests, Misuse of information and Anti-corruption.

Our Ethics Committee

It is the oversight and control body, which guarantees compliance with the Code of Ethics and attends to the most relevant ethical situations of the company. In each of our territories, there is an Ethics Committee and each Committee reports to the Corporate Ethics Committee.

Our KOF Ethics Line

whistleblowing system

Complaints about noncompliance with the Code of Ethics are received through the KOF Ethics Line, which is managed by a third-party. Employees, customers, suppliers, third parties or anyone who has a relationship with Coca-Cola FEMSA can use the system anonymously.

A group of investigators analyzes the complaints impartially and confidentially and, if a violation of the Code is found, corrective measures are applied.

In 2020, we received 1,367 complaints; of these, none were related to child labor, forced labor or freedom of association.

To strengthen our culture, our workers sign a Letter of Compliance to our Code of Ethics. Its purpose is to ensure that our employees are aware of the Code of Ethics, understand the main acts or omissions that may be incurred and can put at risk to our organization and that they must report any violation of the Code that they know.

shareholder & analyst information

Investor Relations

Jorge Collazo

Lorena Martin

Bryan Carlson

Marene Aranzabal

[email protected]

Sustainabiity & Corporate

Communication

Juan Carlos Cortés

Carlos Valle

Pedro Incháustegui

[email protected]

Coca-Cola FEMSA, S.A.B. de C.V.

Mario Pani N° 100

Col. Santa Fe Cuajimalpa 05348,

Ciudad de Mexico, México

(5255) 1519 5000

www.coca-colafemsa.com

Legal Counsel of the Company

Carlos L. Díaz Sáenz

Marío Pani N° 100

Col. Santa Fe Cuajimalpa 05348,

Ciudad de Mexico, México

Phone: (5255) 1519 5000

Independent Accountants

Mancera, S.C.

A member firm of Ernst & Young Global

Antara Polanco

Av. Ejército Nacional Torre Paseo 843-B Piso 4

Colonia Granada 11520

Ciudad de Mexico, México

Phone: (5255) 5283 1400

Stock Exchange Information

Coca-Cola FEMSA’s common stock is traded

on the Bolsa Mexicana de Valores, (the Mexican Stock Exchange) under the symbol KOFUBL and on the New York Stock Exchange, Inc. (NYSE) under the symbol KOF.

Transfer Agent and Registrar

Bank of New York

101 Barclay Street 22W

New York, New York 10286, U.S.A

KOF

New York Stock Exchange

Quarterly Stock Information

| U.S. Dollars per ADS | 2020 | ||

|---|---|---|---|

|

Quarter Ended |

$ High | $ Low | $ Close |

| dec-31 | 46.93 | 36.20 | 46.10 |

| sep-30 | 44.91 | 39.63 | 40.72 |

| jun-30 | 48.39 | 38.09 | 43.85 |

| mar-31 | 64.95 | 38.44 | 40.23 |

| U.S. Dollars per ADS | 2019 | ||

|---|---|---|---|

|

Quarter Ended |

$ High | $ Low | $ Close |

| dec-31 | 61.98 | 54.98 | 60.62 |

| sep-30 | 63.12 | 57.27 | 60.62 |

| jun-28 | 68.51 | 62.03 | 62.14 |

| mar-29 | 66.75 | 58.29 | 66.00 |

KOFUBL

Mexican Stock Exchange

Quarterly Stock Information

| Mexican Pesos | 2020 | ||

|---|---|---|---|

|

Quarter

Ended |

$ High | $ Low | $ Close |

| dec-31 | 93.88 | 77.30 | 91.51 |

| sep-30 | 100.3 | 86.26 | 90.19 |

| jun-30 | 106.29 | 91.49 | 100.62 |

| mar-31 | 121.02 | 90.56 | 95.65 |

| Mexican Pesos | 2019 | ||

|---|---|---|---|

|

Quarter

Ended |

$ High | $ Low | $ Close |

| dec-31 | 121.01 | 105.71 | 114.88 |

| sep-30 | 122.57 | 112.93 | 120.09 |

| jun-28 | 130.07 | 119.05 | 119.11 |

| mar-29 | 128.31 | 114.28 | 128.31 |

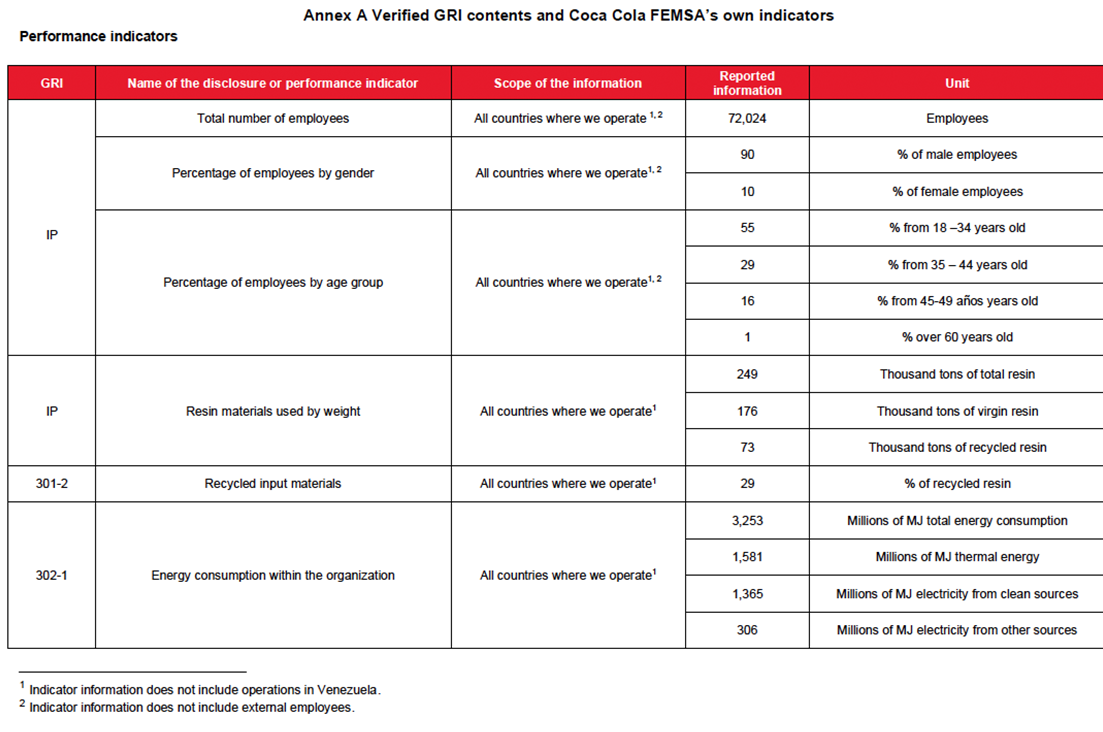

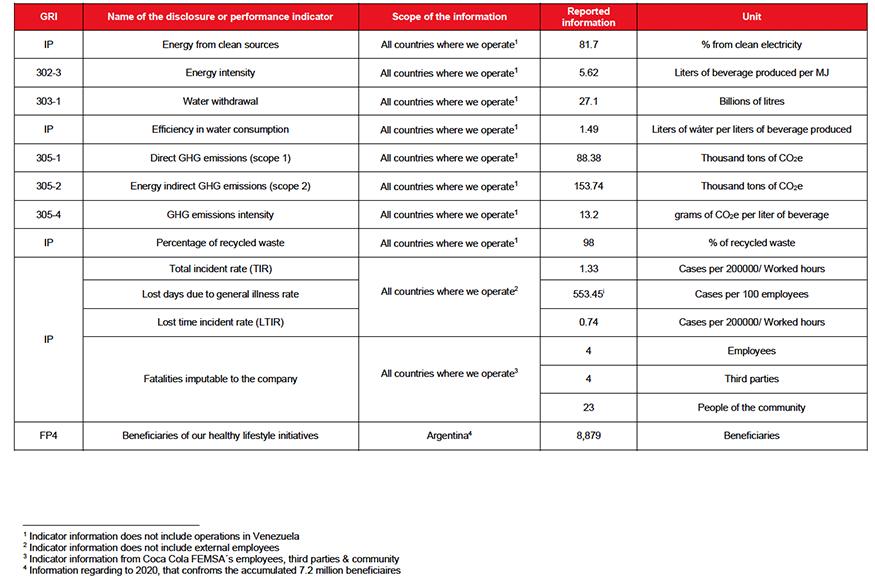

About Our Integrated Report

From our headquarters in Mexico City, we present our Integrated Report 2020 edition. This report was developed following the guidelines of the International Integrated Reporting Council (IIRC) and in accordance with the GRI (Global Reporting Initiative) Standards, as well as material indicators of the SASB (Sustainability Accounting Standards) for the Non-Alcoholic Beverage Industry. Furthermore, this report elaborates on our annual Communication on Progress (COP) to the United Nations Global Compact, included by FEMSA in its 2020 report.

The information contained in this report corresponds to the period from January 1 to December 31, 2020. It includes data from all of the countries where Coca-Cola FEMSA, S.A.B. de C.V. has operations or a majority share. Its operations encompass franchise territories in Mexico, Brazil, Guatemala, Colombia, and Argentina, and, nationwide, in Costa Rica, Nicaragua, Panama, and Uruguay.

For comparability purposes, the non-financial quantitative data for 2020, 2019, and 2018 is represented without Venezuela, since as of December 31, 2017, Venezuela is a deconsolidated operation reported as an investment in shares. Moreover, the 2017 information is represented without the Philippines.

CHIEF FINANCIAL OFFICER

Constantino Spas Montesinos

CORPORATE AFFAIRS OFFICER

José Ramón Martínez Alonso

Stock listing information: Mexican Stock Exchange,

Ticker: KOFUBL | NYSE (ADS),

Ticker: KOF | Ratio of KOFUBL to KOF = 10:1

Coca-Cola FEMSA files reports, including annual reports and other information with the U.S. Securities and Exchange Commission, or the “SEC,” and the Mexican Stock Exchange (Bolsa Mexicana de Valores, or the “BMV”) pursuant to the rules and regulations of the SEC (that apply to foreign private issuers) and of the BMV. Filings we make electronically with the SEC and the BMV are available to the public on the Internet at the SEC’s website at www.sec.gov, the BMV’s website at www.bmv.com.mx, and our website at www.coca-colafemsa.com. Coca-Cola FEMSA, S.A.B. de C.V. is the largest Coca-Cola franchise bottler in the world by sales volume. The company produces and distributes trademark beverages of The Coca-Cola Company, offering a wide portfolio of 129 brands to a population of more than 265 million. With over 80 thousand employees, the company markets and sells approximately 3.3 billion unit cases through close to 2 million points of sale a year. Operating 49 manufacturing plants and 268 distribution centers, Coca-Cola FEMSA is committed to generating economic, social, and environmental value for all of its stakeholders across the value chain. The company is a member of the Dow Jones Sustainability Emerging Markets Index, Dow Jones Sustainability MILA Pacific Alliance Index, FTSE4Good Emerging Index, and the S&P/BMV Total Mexico ESG Index, among others. Its operations encompass franchise territories in Mexico, Brazil, Guatemala, Colombia, and Argentina, and, nationwide, in Costa Rica, Nicaragua, Panama, Uruguay, and in Venezuela through its investment in KOF Venezuela.

For further information, please visit

www.coca-colafemsa.com

stakeholders

We maintain a permanent and open communication with stakeholders, identified based on the materiality assessment we carried out in 2012. This communication helps us understand the interests and concerns of the people who are related, directly or indirectly, to our business activities. We select the stakeholders based on their relationship with each aspect of our value chain, impacts to our operations, and the relevance they hold as part of our purpose of creating shared value.

|

Whistleblower |

01-800 |

e-mail / |

Working |

Community |

Dialogue |

Participation |

Area responsible |

Main issues |

|

|---|---|---|---|---|---|---|---|---|---|

| Associates and their Families | Human Resources | Business philosophy, work culture, labor relations. | |||||||

| Community | Corporate Affairs, Commercial, Human Resources | Community development programs, portfolio of products, job openings, safety at the work centers. | |||||||

| Clients and Consumers | Commercial, Marketing | Different information requests, portfolio of products, job openings, sponsorships, technical assistance, and sales. | |||||||

| Suppliers | Procurement | Commercial relationships. | |||||||

| Shareholders and Investors | Investor Relations | Financial results, company strategy, investment plans, economic prospects. | |||||||

| Authorities and Business Associations | Corporate Affairs | Collaboration in community development initiatives and environmental stewardship. | |||||||

| Unions | Human Resources | Negotiations for collective bargaining contracts, labor relations. | |||||||

| Civil Society Organizations | Corporate Affairs | Joint projects. | |||||||

| Communications Media | Corporate Affairs | Business strategy, financial results, community development programs and environmental stewardship, institutional positioning. | |||||||

| Education Institutes | Human Resources, Corporate Affairs | Joint projects, academic advice, research, training. |

Business engagement

We are interested in promoting and exchanging best practices in Sustainability, and we actively participate in associations and organisms of the countries where we are present.

Coca-Cola FEMSA

Argentina

Brazil

Costa Rica

Guatemala

Mexico

Nicaragua

Panama

Uruguay

Business engagement

Gri content index

GRI 102 General Disclosures

GRI 103 Management Approach

GRI 201 Economic Performance

GRI 203 Indirect Economic Impacts

GRI 204 Procurement Practices

GRI 205 Anti-corruption

GRI 206 Anti-competitive Behavior

GRI 301 Materials

GRI 302 Energy

GRI 303 Water and Effluents

GRI 305 Emissions

GRI 306 Effluents and Waste

GRI 401 Employment

GRI 402 Labor/Management Relations

GRI 403 Occupational Health and Safety

GRI 404 Training and Education

GRI 405 Diversity and Equal Opportunity

GRI 406 Non-discrimination

GRI 407 Freedom of Association and Collective Bargaining

GRI 408 Child Labor

GRI 409 Forced or Compulsory Labor

GRI 411 Rights of Indigenous Peoples

GRI 412 Human Rights Assessment

GRI 413 Local Communities

GRI 414 Supplier Social Assessment

GRI 416 Customer Health and Safety

SASB index

Energy Management

Water Management

Health & Nutrition

Product Labeling & Marketing

Packaging Lifecycle Management

Environmental & Social Impacts of Ingredient Supply Chain

Activity Metrics